Preapproval

What is a mortgage preapproval?

A mortgage preapproval is a letter from a lender that states how much money they are willing to lend you to buy a home. It is not a guarantee of a loan, but it is a good indicator of how much you can afford to borrow.

Benefits of getting preapproved

It shows realtors that you are capable of confidently looking at homes and making offers.

It shows sellers that you are a serious buyer.

It can help you close on your home faster.

How to get preapproved

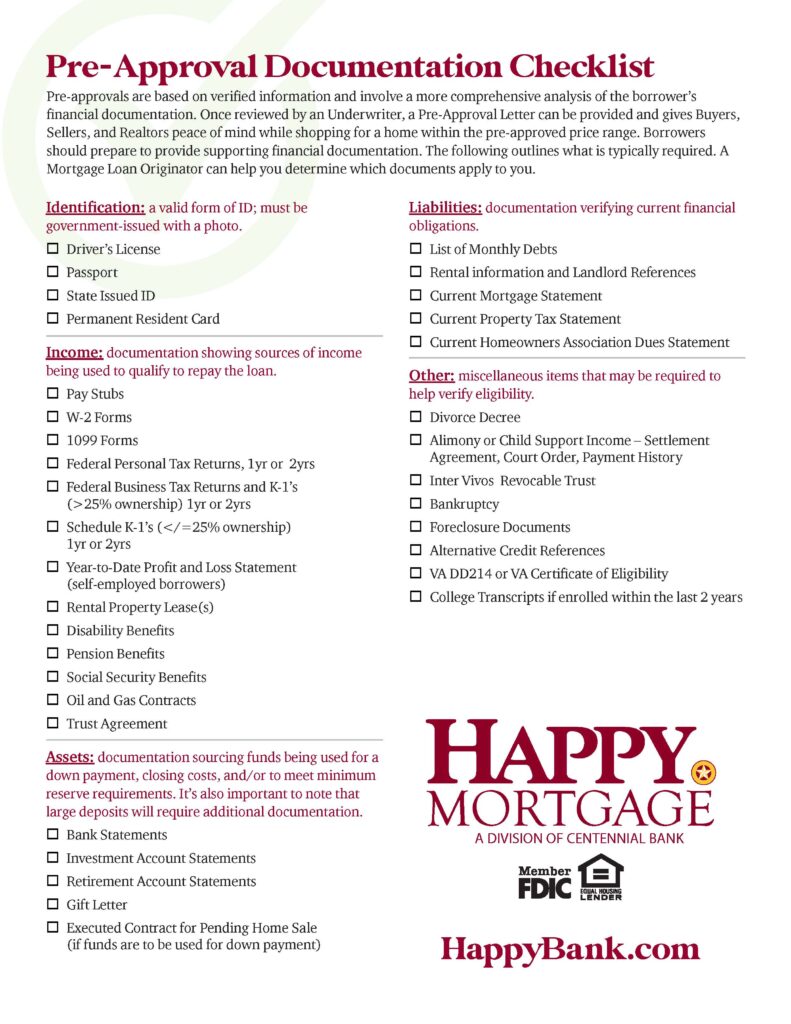

To get preapproved for a mortgage, you will need to provide your lender with some financial information, including your income, assets, and debts. You will also need to authorize a credit check.

-

This includes your most recent pay stubs, W-2s, tax returns, and bank statements.

-

You can apply for preapproval online, over the phone, or in person at a branch.

-

You will need to provide information about your income, assets, and debts.

-

This will allow Happy Mortgage to assess your creditworthiness.

-

Once you are preapproved, you will receive a letter that states the amount of money you are preapproved to borrow.

Tips for getting preapproved

Get your credit score in good shape

The higher your credit score, the better your chances of getting preapproved for a mortgage.

Save up for a down payment

A larger down payment will make you a more attractive borrower.

Get your financial documents in order

This will make the preapproval process go more smoothly.